The banks of the future will run on our phones

T3 takes Monzo for a spin

Get all the latest news, reviews, deals and buying guides on gorgeous tech, home and active products from the T3 experts

You are now subscribed

Your newsletter sign-up was successful

With the established banks taking their time to roll out online services and apps for managing your money, various smaller enterprises are starting up to fill the gap: banks that are first and foremost apps on your phone, with no high street branches at all.

One such project is Monzo, which launched in 2015 and is still in a phase of limited beta testing. You can sign up for an account via the apps for iOS or Android, after which you get a prepaid debit card through the post, which you need to load up with £100 of your cash.

How Monzo works

Monzo labels itself as "the bank of the future" and at its core it's about the contactless, straightforward payments you're already used to with none of the extra clutter.

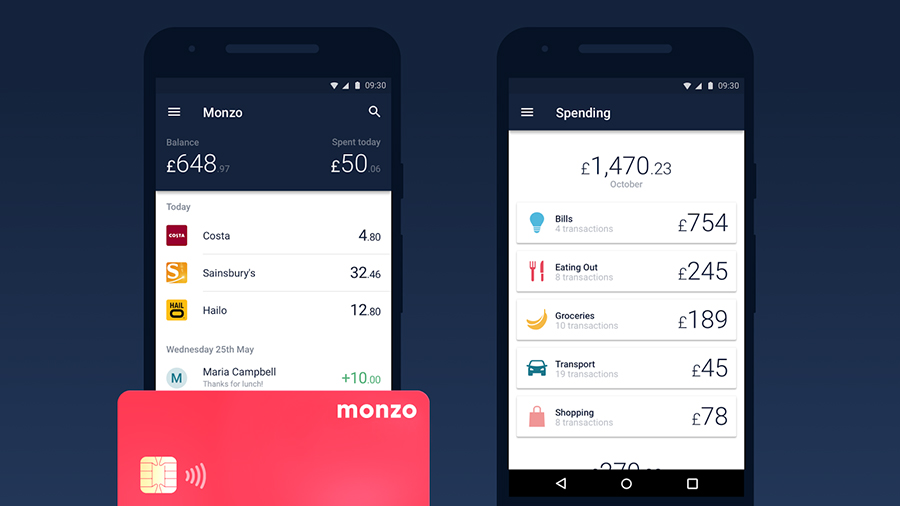

That means payments that register instantly in your account, for example, rather than taking hours or days to show up, and no charges for using your card abroad. You also have the option to send money instantly to anyone else using Monzo.

The phone app is the centre of the Monzo experience: payments show up instantly before you've even walked out of the shop, and your spending is automatically itemised (into groceries, food and so on) so you can see what you're spending and where.

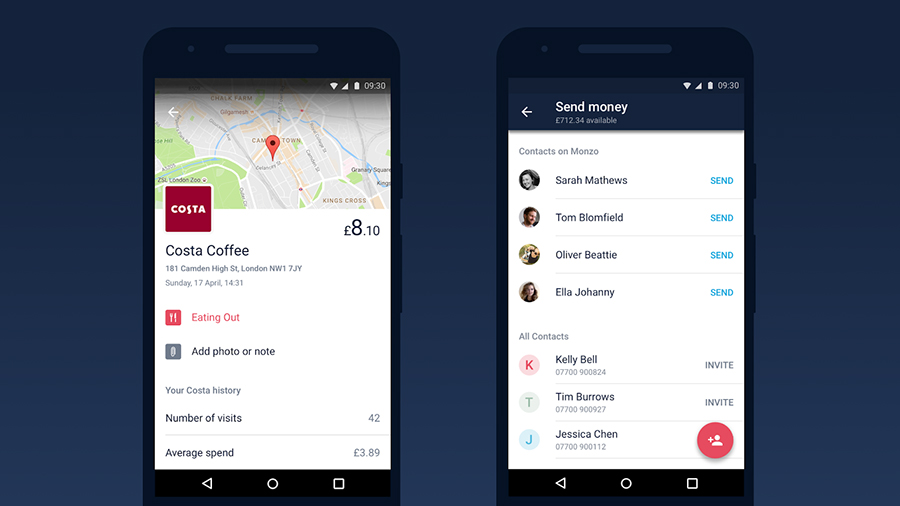

Call into Costa Coffee on a regular basis, for instance, and the Monzo app shows you how many times you've visited and what your average spend is.

Photos or notes can be added to any of your transactions (pictures of a receipt maybe) and you get other cool features in the app as well, like the ability to freeze your card if it goes missing.

Get all the latest news, reviews, deals and buying guides on gorgeous tech, home and active products from the T3 experts

As we've mentioned, it's still early days for Monzo, and options like budgeting targets and improved search facilities are planned for the future.

Spending money with Monzo

We've been using Monzo for a month or so and it's been a completely smooth and very convenient experience. Having to preload your card with £100 from somewhere else isn't ideal, but once it's fully up and running as a bank, a Monzo account will work like any other current account.

Withdrawing cash from an ATM, paying with contactless, and paying with the older PIN method - everything we've done with Monzo has been trouble-free, though to be fair we haven't tried any shops too far off the beaten track.

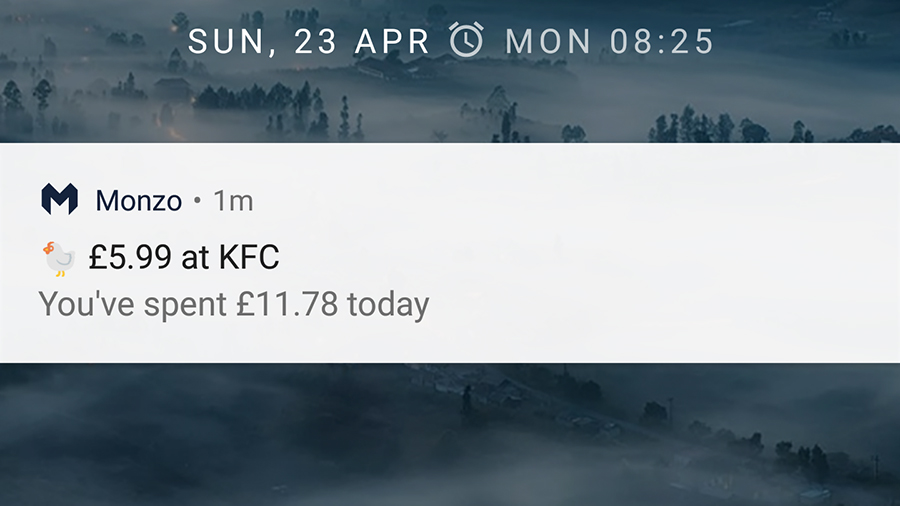

Having a phone alert appear as soon as you spend money feels like magic - but isn't this how banking should be in 2017? Ditto the breakdown of everything you're spending inside the app, which is going to save you hours compared with typing everything manually into an expenditure spreadsheet (kudos to you if this is something you already do).

Splitting bills and sending money works perfectly too, although you do need your friends to have signed up for Monzo as well.

The only sign that Monzo hasn't yet graduated to a fully licensed bank is the rather awkward setup process, but everything else feels ready for primetime. Having to go back to our usual credit and debit cards felt like taking a step into the past - a sign of just how handy Monzo already is.

Is this really the future?

In five years time there's no doubt everybody will be banking like this - whether it's through new startups like Monzo or the older banks getting their mobile act together.

Add integrations like Apple Pay and Android Pay and you won't even need to carry a card around with you.

These sort of innovations have been on the horizon for some time, though with so much back-end technology and security to sort out, it's perhaps understandable that it's taken a while for banking to go truly mobile. Still, apps such as PayPal and Venmo have been showing how it's done for several years now.

Users are of course going to be concerned about keeping their money safe, but again modern technology like fingerprint sensing makes that possible.

It's really in the software where the real progress can be made, not necessarily how you pay for your stuff: itemised billing, an instant overview of your account, filters based on category and location, and so on.

A lot of apps can already do this, but dragging the necessary data out of your bank is still clunky and awkward - with Monzo it's like having a Fitbit tracker for your money, where everything gets logged for you automatically.

Other banking apps to watch

Monzo isn't the only 'future bank' looking to change the way you spend and manage money on your phone.

Atom Bank, for example, is another mobile-first banking startup in the UK, which lets you log into your account using face and voice recognition. Atom focuses on savings and mortgages rather than day-to-day payments, and comes with features like mobile app alerts and easy management from your phone.

Also worth getting on your radar is Chip, which provides analytics on how you spend your money and automatically funnels savings out of your current account based on what it thinks you can spare. Money can be transferred with just a few taps and the app is so confident in its algorithms that it will give you a refund and £10 if one of its automatic transactions puts you in your overdraft.

Meanwhile Monese works like a proper current account, with quick deposits, tracking on your spending, instant balance checks and cheap rates for spending money abroad. You don't even need a UK address to open up an account.

In other words: high street banks, it's over to you.

Dave has over 20 years' experience in the tech journalism industry, covering hardware and software across mobile, computing, smart home, home entertainment, wearables, gaming and the web – you can find his writing online, in print, and even in the occasional scientific paper, across major tech titles like T3, TechRadar, Gizmodo and Wired. Outside of work, he enjoys long walks in the countryside, skiing down mountains, watching football matches (as long as his team is winning) and keeping up with the latest movies.